Indian Economy : News,Discussions & Updates

- Thread starter Butter Chicken

- Start date

-

- Tags

- indian defence forum

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Totally lazy journalism as far as figures for the ac industry go. 1 lakh crore translates to 13 billion USD wheras the total ac market including accessories & ancillary work isn't more than 4-5 billion USD & I'm stretching it far too much for my own comfort. Assembly units can be set up for less than 300-400 crores - units which can churn out millions of room air conditioners, enough time cater to domestic requirements & exports of substantial numbers .

Why would we require billions of dollars in investment in this sector is beyond me?

Secondly if India is really interested in making itself an attractive destination for manufacturing, I think they ought to shed inhibitions like deciding they don't want to get into "low tech manufacturing" Like furniture, etc.

Having invested billions into setting up plants & SC across ASEAN nations & the far East notably China for hi tech sectors like consumer electronics , chip fabs, etc these behemoths aren't in a position to wind up operations in a day & quit even if they wanted to.

Just goes to prove the ordinary sarkaari babu has his head up his *censored* & is totally out of depth with market realities.

Why would we require billions of dollars in investment in this sector is beyond me?

Secondly if India is really interested in making itself an attractive destination for manufacturing, I think they ought to shed inhibitions like deciding they don't want to get into "low tech manufacturing" Like furniture, etc.

Having invested billions into setting up plants & SC across ASEAN nations & the far East notably China for hi tech sectors like consumer electronics , chip fabs, etc these behemoths aren't in a position to wind up operations in a day & quit even if they wanted to.

Just goes to prove the ordinary sarkaari babu has his head up his *censored* & is totally out of depth with market realities.

There are no hi-tech fabs in China that I am aware of. Al latest technology fabs are either in Taiwan, Korea or USA.Totally lazy journalism as far as figures for the ac industry go. 1 lakh crore translates to 13 billion USD wheras the total ac market including accessories & ancillary work isn't more than 4-5 billion USD & I'm stretching it far too much for my own comfort. Assembly units can be set up for less than 300-400 crores - units which can churn out millions of room air conditioners, enough time cater to domestic requirements & exports of substantial numbers .

Why would we require billions of dollars in investment in this sector is beyond me?

Secondly if India is really interested in making itself an attractive destination for manufacturing, I think they ought to shed inhibitions like deciding they don't want to get into "low tech manufacturing" Like furniture, etc.

Having invested billions into setting up plants & SC across ASEAN nations & the far East notably China for hi tech sectors like consumer electronics , chip fabs, etc these behemoths aren't in a position to wind up operations in a day & quit even if they wanted to.

Just goes to prove the ordinary sarkaari babu has his head up his *censored* & is totally out of depth with market realities.

As far as electronics assembly is concerned, it does require significant investment particularly for PCB manufacturing and high precision assembly. This transfer has been on cards for past few years for multiple reasons like

1. Increase in cost in China

2. Trade war

3. High import duty

But what really accelerated the decision is Covid and the risk of single source.

I sincerely hope Indian government grabs this opportunity with both hands !!

Building Atmanirbhar Bharat: Licences likely for furniture, sports gear and toy imports

By Kirtika Suneja & Gulveen Aulakh

The government has decided to license these imports after finding that higher duties have been ineffective in reducing the amount of goods coming into India, even as they raise costs for domestic industry. The licence requirements serve as non-tariff barriers that discourage imports. According to experts, cheap imported goods have been finding their way into the country through the misuse of free trade agreement route.

NEW DELHI: Imports of furniture, toys and sports goods are likely to require licences soon, a measure the government hopes will reduce imports and encourage domestic production, said people with knowledge of the matter. India has already imposed licensing requirements for tyres and colour TV imports, a big percentage of which comes from China. The government may also raise import duties for certain products to their bound rates to make imports costlier. Bound tariffs are the ceiling rates specified at the WTO beyond which countries cannot raise duties.

The government has decided to license these imports after finding that higher duties have been ineffective in reducing the amount of goods coming into India, even as they raise costs for domestic industry, officials said. The licence requirements serve as non-tariff barriers that discourage imports. Cheap imported goods have been finding their way into the country through the misuse of free trade agreement route, officials said.

"Non-duty actions like import curbs are one of the main actions available to the government as many of these are coming at low duty and which cannot be controlled through increased tariffs," said an official. The products for which import restrictions are being considered are part of the 20 industrial sectors in which India has a manufacturing advantage and can attract investments, as identified by the government.

Consultations on with industry

These include standard and special furniture, air-conditioners, leather, footwear, agro-chemicals, ready-to-eat food, steel, aluminium, copper, textiles, electric vehicles, auto components, TV set-top boxes, CCTVs, sports goods, ethanol & bio-fuels, and toys.

This is not a unilateral exercise and consultations are on with industry on ways to reduce imports, the official said. "So, industry will be able to rapidly move to domestic manufacturing without consumers seeing any price escalation," the person added. The government had launched the Atmanirbhar Bharat Abhiyan, or self-reliant India programme, in May as part of a strategy to reduce dependence on imports and revive the economy in the wake of the Covid-19 pandemic.

Industry backs move

Industry has sought transition time and the issuance of ad hoc licences for tyres and TVs to facilitate traders, as goods worth several crores of rupees are in transit or advance payments have been made or orders have been placed. Televisions worth Rs 600-700 crore are imported into India every month, sources said. Companies such as Samsung, Vu, Xiaomi and Cloudtail, a popular seller on Amazon.in, are among the leading importers, they added.

Industry sources also added that imports worth nearly $400 million were coming from Vietnam, followed by over $300 million from China, prompting another look at the free trade agreement India has with the Southeast Asian nation and whether it's being misused.

"There's going to be an additional layer of compliance to be fulfilled, which in our understanding could be onerous and would be possible only for those products for which we do not have capacity or expertise in-house or for players demonstrating value addition," said Divakar Vijayasarathy, founder and managing partner, DVS Advisors LLP.

The procedures are yet to be notified, he said. Smaller companies, which merely import goods and attach labels in India, may find the going especially difficult, he said.

economictimes.indiatimes.com

economictimes.indiatimes.com

By Kirtika Suneja & Gulveen Aulakh

Synopsis

The government has decided to license these imports after finding that higher duties have been ineffective in reducing the amount of goods coming into India, even as they raise costs for domestic industry. The licence requirements serve as non-tariff barriers that discourage imports. According to experts, cheap imported goods have been finding their way into the country through the misuse of free trade agreement route.

NEW DELHI: Imports of furniture, toys and sports goods are likely to require licences soon, a measure the government hopes will reduce imports and encourage domestic production, said people with knowledge of the matter. India has already imposed licensing requirements for tyres and colour TV imports, a big percentage of which comes from China. The government may also raise import duties for certain products to their bound rates to make imports costlier. Bound tariffs are the ceiling rates specified at the WTO beyond which countries cannot raise duties.

The government has decided to license these imports after finding that higher duties have been ineffective in reducing the amount of goods coming into India, even as they raise costs for domestic industry, officials said. The licence requirements serve as non-tariff barriers that discourage imports. Cheap imported goods have been finding their way into the country through the misuse of free trade agreement route, officials said.

"Non-duty actions like import curbs are one of the main actions available to the government as many of these are coming at low duty and which cannot be controlled through increased tariffs," said an official. The products for which import restrictions are being considered are part of the 20 industrial sectors in which India has a manufacturing advantage and can attract investments, as identified by the government.

Consultations on with industry

These include standard and special furniture, air-conditioners, leather, footwear, agro-chemicals, ready-to-eat food, steel, aluminium, copper, textiles, electric vehicles, auto components, TV set-top boxes, CCTVs, sports goods, ethanol & bio-fuels, and toys.

This is not a unilateral exercise and consultations are on with industry on ways to reduce imports, the official said. "So, industry will be able to rapidly move to domestic manufacturing without consumers seeing any price escalation," the person added. The government had launched the Atmanirbhar Bharat Abhiyan, or self-reliant India programme, in May as part of a strategy to reduce dependence on imports and revive the economy in the wake of the Covid-19 pandemic.

Industry backs move

Industry has sought transition time and the issuance of ad hoc licences for tyres and TVs to facilitate traders, as goods worth several crores of rupees are in transit or advance payments have been made or orders have been placed. Televisions worth Rs 600-700 crore are imported into India every month, sources said. Companies such as Samsung, Vu, Xiaomi and Cloudtail, a popular seller on Amazon.in, are among the leading importers, they added.

Industry sources also added that imports worth nearly $400 million were coming from Vietnam, followed by over $300 million from China, prompting another look at the free trade agreement India has with the Southeast Asian nation and whether it's being misused.

"There's going to be an additional layer of compliance to be fulfilled, which in our understanding could be onerous and would be possible only for those products for which we do not have capacity or expertise in-house or for players demonstrating value addition," said Divakar Vijayasarathy, founder and managing partner, DVS Advisors LLP.

The procedures are yet to be notified, he said. Smaller companies, which merely import goods and attach labels in India, may find the going especially difficult, he said.

Building Atmanirbhar Bharat: Licences likely for furniture, sports gear and toy imports

The government has decided to license these imports after finding that higher duties have been ineffective in reducing the amount of goods coming into India, even as they raise costs for domestic industry. The licence requirements serve as non-tariff barriers that discourage imports. According...

Gadkari approves scheme to make India self-reliant in agarbatti production

The programme named 'Khadi Agarbatti Aatmanirbhar Mission' aims at creating employment for unemployed and migrant workers in different parts of the country while increasing domestic agarbatti production substantially, the MSME Ministry said.

By PTI

August 03, 2020, 08:54 IST

NEW DELHI: MSME minister Nitin Gadkari has approved an employment generation programme proposed by Khadi and Village Industries Commission(KVIC) to make India self-reliant in agarbatti production. The programme named 'Khadi Agarbatti Aatmanirbhar Mission' aims at creating employment for unemployed and migrant workers in different parts of the country while increasing domestic agarbatti production substantially, the MSME Ministry said.

"The proposal was submitted to the Ministry of MSME for approval last month. The pilot project will be launched soon and on full-fledged implementation of the project, thousands of jobs will be created in the agarbatti industry," the ministry said. The programme aims at handholding artisans and supporting the local agarbatti industry. The current consumption of agarbatti in the country is approximately 1,490 MT per day but local production is just 760 MT.

There is a huge gap between the demand and the supply and hence, immense scope for job creation, said the ministry. Under the scheme, KVIC will provide automatic agarbatti making machines and powder mixing machines to the artisans through the successful private agarbatti manufacturers who will sign the agreement as business partners. KVIC has decided to procure only locally-made machines by Indian manufacturers. The Centre earlier took two major decisions by placing the agarbatti item from “free” trade to 'restricted' trade in the import policy and enhancing the import duty from 10 per cent to 25 per cent on 'round bamboo sticks' used for manufacturing of agarbatti for the benefit of the domestic industry.

KVIC Chairman Vinai Kumar Saxena said the two decisions of the central government created a huge employment opportunity in the agarbatti industry. "In order to encash the huge employment generation opportunity, the KVIC designed a programme namely 'Khadi Agarbatti Aatmanirbhar Mission' and submitted to the Ministry of MSME for approval,” Saxena said.

KVIC will provide 25 per cent subsidy on the cost of the machines and recover the remaining 75 per cent of the cost from the artisans in easy instalments every month. Under the scheme, the business partner will provide raw material to artisans for making agarbatti and pay them wages on job work basis. The cost of artisans' training will be shared between KVIC and the private business partner wherein the Commission will bear 75 per cent of the cost while 25 per cent will be paid by the business partner. "Each automatic agarbatti-making machine makes approximately 80 kg agarbatti per day which will provide direct employment to four persons. One powder mixing machine, to be given on a set on five agarbatti making machines, will provide employment to two persons," the MSME Ministry said.

The wages to the artisans will be provided by the business partners on weekly basis directly in their accounts through direct benefit transfer only.

retail.economictimes.indiatimes.com

retail.economictimes.indiatimes.com

The programme named 'Khadi Agarbatti Aatmanirbhar Mission' aims at creating employment for unemployed and migrant workers in different parts of the country while increasing domestic agarbatti production substantially, the MSME Ministry said.

By PTI

August 03, 2020, 08:54 IST

NEW DELHI: MSME minister Nitin Gadkari has approved an employment generation programme proposed by Khadi and Village Industries Commission(KVIC) to make India self-reliant in agarbatti production. The programme named 'Khadi Agarbatti Aatmanirbhar Mission' aims at creating employment for unemployed and migrant workers in different parts of the country while increasing domestic agarbatti production substantially, the MSME Ministry said.

"The proposal was submitted to the Ministry of MSME for approval last month. The pilot project will be launched soon and on full-fledged implementation of the project, thousands of jobs will be created in the agarbatti industry," the ministry said. The programme aims at handholding artisans and supporting the local agarbatti industry. The current consumption of agarbatti in the country is approximately 1,490 MT per day but local production is just 760 MT.

There is a huge gap between the demand and the supply and hence, immense scope for job creation, said the ministry. Under the scheme, KVIC will provide automatic agarbatti making machines and powder mixing machines to the artisans through the successful private agarbatti manufacturers who will sign the agreement as business partners. KVIC has decided to procure only locally-made machines by Indian manufacturers. The Centre earlier took two major decisions by placing the agarbatti item from “free” trade to 'restricted' trade in the import policy and enhancing the import duty from 10 per cent to 25 per cent on 'round bamboo sticks' used for manufacturing of agarbatti for the benefit of the domestic industry.

KVIC Chairman Vinai Kumar Saxena said the two decisions of the central government created a huge employment opportunity in the agarbatti industry. "In order to encash the huge employment generation opportunity, the KVIC designed a programme namely 'Khadi Agarbatti Aatmanirbhar Mission' and submitted to the Ministry of MSME for approval,” Saxena said.

KVIC will provide 25 per cent subsidy on the cost of the machines and recover the remaining 75 per cent of the cost from the artisans in easy instalments every month. Under the scheme, the business partner will provide raw material to artisans for making agarbatti and pay them wages on job work basis. The cost of artisans' training will be shared between KVIC and the private business partner wherein the Commission will bear 75 per cent of the cost while 25 per cent will be paid by the business partner. "Each automatic agarbatti-making machine makes approximately 80 kg agarbatti per day which will provide direct employment to four persons. One powder mixing machine, to be given on a set on five agarbatti making machines, will provide employment to two persons," the MSME Ministry said.

The wages to the artisans will be provided by the business partners on weekly basis directly in their accounts through direct benefit transfer only.

Gadkari approves scheme to make India self-reliant in agarbatti production - ET Retail

Atmanirbhar Bharat: The programme named 'Khadi Agarbatti Aatmanirbhar Mission' aims at creating employment for unemployed and migrant workers in different parts of the country while increasing domestic agarbatti production substantially, the MSME Ministry said.

India restricts entry of Chinese firms in commercial coal mine auctions - ET EnergyWorld

Private Sector: Also, proposals from companies, where the beneficial owner is situated in or is a citizen of any such country sharing a land border with India, will also have to go through the government route

With RIL eyeing Netmeds deal, ePharmacy in for consolidation

Reliance's yet-to-be announced acquisition of Netmeds for an estimated $120 million is a catalyst for other players such as PharmEasy and Medlife to explore merger and acquisition negotiations.

Did u read your own source?no where it says 800 million. Poverty gap at 3.20 is 20% of population i.e 250 million(2011) and it is based on ppp, its even reduced more now...

Poverty head count is 21%.

How did u get 800 million

Because some people like to portray India as poor , corrupt and incapable of handling its affairs. They enjoy it. That is why they will exaggerate flip side of India.

Rebooting Economy XIII: Why Indian corporates are debt-ridden

India faces a fresh threat of NPAs with RBI warning dramatic rise in loan default rate from 8.5% in FY20 to 14.7% in FY21. A global study shows the Indian corporate sector was most debt-stressed with 43% of long-term loans vulnerable to default even before the COVID-19 pandemic hit

On July 31, 2020, Finance Minister Nirmala Sitharaman announced that talks were on with the banking regulator RBI to extend the moratorium on repayments and restructuring of borrowings beyond August 31.

This was after the RBI released its Financial Stability Report on July 24 issuing a dire warning: Macro stress tests indicate that the Gross NPA (GNPA) ratio of the Scheduled Commercial Banks (SCBs) could rise from 8.5% in FY20 to 12.5% under baseline scenario and 14.7% under very severe stress in FY21 because of the lockdown-induced economic disruptions.

Although Sitharaman's statement came in the context of hospitality industry, extension of moratorium or restructuring of borrowings can never be restricted to one sector since many others, like aviation and MSMEs, are hit equally hard too.

Evidence shows such remedies are fraught with damaging consequences for the economy by worsening the debt crisis and weakening banking finances. But before getting there here is how big the debt crisis is.

What do GNPA ratios of 12.5% to 14.7% mean to Indian economy?

The RBI has stopped providing data on the non-performing assets (NPAs) it is writing off every year, thereby blunting accountability and transparency in its operations. It hasn't revealed the GNPA for FY20 in absolute number (in Rs crore) either, but says the GNPA ratio (GNPA/Gross Advances) in FY20 is 8.5%.

But this can be easily calculated. Here is how.

The simple averages of the GNPAs and Gross Advances of the SCBs for the previous five years between FY15 and FY19 (for which data is available in the RBI database) work out to be Rs 7.4 lakh crore and Rs 87.5 crore, respectively.

Let us assume these average holds for FY20.

Now the GNPA ratio for FY20 works out to be 8.5%, perfectly matching with the RBI's declaration (that is perhaps how the RBI calculated it too).

Assume also that the FY20 levels of GNPA and Gross Advance hold true for FY21. What would the projected rise in the GNPA ratios to 12.5% and 14.7% mean for the GNPA in absolute terms?

The GNPAs for FY21 would be Rs 11 lakh crore and Rs 13 lakh crore, respectively.

These are very big numbers - 7.5% to 9% of the FY20 GDP (GDP at constant prices for FY20 is Rs 145.66 lakh crore, according to the NSO's May 29, 2020 statement).

Imagine there is no GNPA for FY21. Banks would not have to set aside money as contingency cover. Also imagine if a part of the GNPA is not written off, partially or fully, in subsequent years.

The entire amount of Rs 11-13 lakh crore plus banks' provisioning against it would be available and work to revive the lockdown-hit economy.

Two important facts should be kept in mind here: (i) the RBI routinely writes of NPAs even when it is wilful (those who can pay but don't are classified as "wilful defaulters"), letting private corporates routinely get away with public money and (ii) the public sector banks (PSBs) account for more than 80% of total GNPAs in the SCBs (86% in FY18), which are compensated (recapitalised) later with more public money.

Writing off NPAs is a double loss to the economy: (i) loss of public money (deposits) in the SCBs (Rs 11-13 lakh crore) and (ii) the subsequent recapitalisation of PSBs with more public money (to the extent the NPAs are written off).

Dire warning against growing debt across world

Even before the pandemic hit, the world was witnessing a phenomenal rise in debt against which multiple agencies were issuing warnings. The lockdown would surely be worsening it.

For example, Kristalina Georgieva, managing director of the International Monetary Fund (IMF), warned on November 7, 2019, that the global debt - both public and private taken together - had reached an all-time high of $188 trillion or 230% of global output (GDP).

The IMF had organised a conference in Washington to discuss the development which she was addressing.

She cautioned: "Think of the devastating effects of unsustainable credit booms, including in the run-up to the global financial crisis (2007-08).A major driver of this build-up is the private sector, which currently makes up almost two-thirds of the total debt level."

She went on to explain: "But that is only part of the story...Remember: the build-up of public debt has a lot to do with the policy response to the 2008 financial crisis - when private debt moved to public balance sheets, especially in advanced economies. Recent IMF staff research shows that direct public support to financial institutions (banks and others) alone amounted to $1.6 trillion during the 2008 crisis."

Writing off NPAs (private businesses' loan defaults) by the RBI similarly shifts private debts to public accounts. India witnessed rapid lending in recent years - target-driven MUDRA loans and continuous lowering of interest rates that endured in the post-lockdown period. More than 90% of India's economic package of Rs 21 lakh crore consists of facilitating credit or liquidity infusion.

Here is the latest update on global and Indian debts.

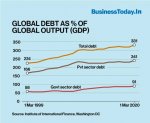

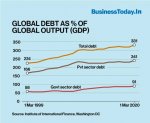

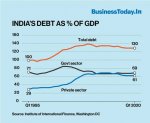

The Washington-based Institute of International Finance (IIF), an association of financial industries, provides debt positions four times a year. Last updated in July 2020, its data is presented in the following graph, using only the debt position as on March 1 of every financial year.

The data shows, the total global debt stood at $258 trillion on March 1, 2020, which was 331% of the global output (GDP) - up from $184.4 or trillion 10 years earlier on March 1, 2010. Private sector debt accounted for 73% of the total GDP or $188 trillion (it includes household debt of $48.1 trillion).

What about India?

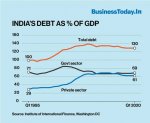

The IIF provides data for India only in terms of GDP, not in absolute value. Its data shows the total debt stood at 130% of the GDP in the January-March 2020 quarter. India's government debt stood at 69% of the GDP and that its private sector 61%. But that is only one part of the story

Indian businesses show highest debt-stress level

The US management consultancy firm McKinsey & Company had warned about debt-stress in corporate entities in its July 2019 report, "Signs of stress in the Asian financial system".

It singled out countries like India, where it said the signal was "ominous" and called for monetary policy reviews and preventive actions.

The report showed India's corporate sector had the highest level of debt-stress in the world in 2017 with 43% of long-term loans facing potential default (interest coverage ratio of less than 1.5) - a rise of 30% from 2007. This is far more than 37% for China but India never attracted the kind of global attention China did.

It further pointed out that the corporate debt-stress was spread across sectors: industrial (capital goods, commercial professional services, transportation etc.), utilities, energy, real estate, and materials (in decreasing order).

Though this graph doesn't differentiate between public and private sector corporates, data from the bankruptcy proceedings (under the Insolvency and Bankruptcy Code) and other financial reports show that debt stress is predominant in the private sector.

The McKinsey report also highlighted a structural weakness in India's lending system that remains unaddressed as yet: high-risk lending by poorly regulated non-banking financial institutions (NBFCs).

It said: "In India, while (regulated) banks reduced lending as defaults showed signs of growing around 2014, nonbank financial intermediaries continued to lend. The Reserve Bank of India, India's central bank, estimates that 99.7 percent of nonbank finance companies (NBFCs) and housing companies make long-term loans against short-term funding."

That India's corporate debt-stress remains elevated has been flagged off by the global financial services agency Credit Suisse for at least three consecutive years since FY17.

It's "India Corporate Health Tracker" of August 2019 shows that barring a few, all familiar big private business houses figure in the list of 49 "chronically stressed" corporates (interest cover ratio of less than 1 for a period of 1 to 12 quarters).

The names include one or more entities belonging to the Reliance, Tata and Adani stables. A few are public sector entities, like the SAIL, MTNL, Shipping Corporation, Mangalore Refinery, Petrochemicals, and Chennai Petroleum. Debt stress is spread across sectors like infrastructure, manufacturing, telecom, power, metals, textiles, etc.

The debt of these 49 chronically stressed companies has been consistently rising from Rs 8.9 lakh crore in FY17 to Rs 9.1 lakh crore in FY 18 and Rs 10.2 lakh crore in FY19.

Why Indian corporates are debt-ridden?

The findings of the McKinsey and Credit Suisse reports raise many fundamental questions.

Why are India's big and apparently successful corporate entities debt-ridden? Why don't they use their own money - accumulated profits and wealth over the years -or infuse equity for establishing new businesses or expanding existing ones? Are they really stressed or is it a deliberate ploy to misappropriate public money?

The last question arises not only because the Indian government and RBI routinely write off corporate loans as NPAs (even if wilful) without question (the data is also kept hidden from public eye) but also because a series of corporate frauds have flooded out in the past couple of years: PMC, PNB, IL&FS, HDIL, DHFL, Yes Bank, ICICI-Videocon, and NSEL scams to name some.

Some of these scams reveal years of fraudulent financial dealings, others demonstrate outright loot of public money (for example, Nirav Modi, Mehul Choksi, Vijay Mallya, Jatin Mehta and many others fled India after pocketing public money).

In all, 36 such businessmen fled in recent years, the Enforcement Directorate (ED) told a court. With the Insolvency and Bankruptcy Code now diluted, the misappropriation of public money is more likely.

Leaving aside malfeasance, debt-driven businesses are a common phenomenon. With the economic slowdown, the chances of defaults are now heightened with an already debt-stressed corporate sector.

Moratorium and restructuring of loans are bad ideas

Should the RBI then continue lowering interest rates to push supply-driven-credit? The repo rate (rate at which the RBI lends to banks) has fallen from 6% in April 2018 to 3.5% in May 2020, the capital reserve ratio (CRR) is down to 3% for FY21 with no corresponding gain seen in the economy.

Most of the liquidity gets parked in the RBI's reverse repo account and it is well known to bankers and policymakers. In effect, the RBI and government know liquidity infusion is a spectacular failure and yet the push for more of the same continues.

A day after the IMF's Kristalina Georgieva warned against the growing global debt, the main speaker of the event Jeremy Stein, a Harvard professor, issued a dire warning.

His presentation read: "Supply-driven credit booms - accompanied by aggressive pricing and erosion of credit quality - appear to play a big role in fluctuations in economic activity across a wide range of sample periods, countries, and institutional arrangements."

It said such supply-side credit push brings "not just financial crises, but garden-variety recessions as well."

Not long ago, economist Joseph Stiglitz too had warned against supply-drive debt push: "...periods of rapid lending are often associated with bubbles like the tech bubble and the real estate bubbles in the US. (There is again typically a causal link: rapid lending helps create and sustain these bubbles.) Such bubbles make the assessment of risk more difficult."

Here is a warning from India's largest public sector bank SBI about extending moratorium on debt repayment.

On August 3, 2020, its research paper said: (i) 70% of the total moratorium have been availed by corporates which are rated A and above - those who can easily repay with "comfortable debt-equity ratio" (those with comfortable debt-equity are spread across sectors like pharma, FMCG, chemicals, healthcare, consumer durable, auto, etc.) and (ii) consumer loans declined by Rs 53,023 crore in the current fiscal, but "consumer leverage in lieu of exposure to stock market" increased by Rs 469 crore that could be a potential source of financial instability".

It warned that a blanket extension of moratorium beyond August 31 would "do more harm than good".

As for restructuring of bad loans that the government talks of, the IBC was brought in in 2018 precisely because the earlier regime of restructuring was a disaster and ended up ever-greening bad loans and caused higher losses as more good public money was thrown after bad money year after year.

Here is more food for thought.

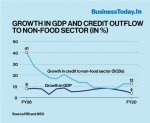

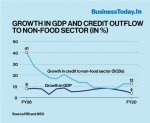

How does India's economic growth square up with growth in bank loans?

The following graph presents data from the RBI and NSO for a period of 15 years (FY06 to FY20).

The correlation seems tenuous, doesn't it? Thereby hangs another tale.

@Milspec @Deathstar @HariPrasad @Ashwin @Falcon your view

India faces a fresh threat of NPAs with RBI warning dramatic rise in loan default rate from 8.5% in FY20 to 14.7% in FY21. A global study shows the Indian corporate sector was most debt-stressed with 43% of long-term loans vulnerable to default even before the COVID-19 pandemic hit

On July 31, 2020, Finance Minister Nirmala Sitharaman announced that talks were on with the banking regulator RBI to extend the moratorium on repayments and restructuring of borrowings beyond August 31.

This was after the RBI released its Financial Stability Report on July 24 issuing a dire warning: Macro stress tests indicate that the Gross NPA (GNPA) ratio of the Scheduled Commercial Banks (SCBs) could rise from 8.5% in FY20 to 12.5% under baseline scenario and 14.7% under very severe stress in FY21 because of the lockdown-induced economic disruptions.

Although Sitharaman's statement came in the context of hospitality industry, extension of moratorium or restructuring of borrowings can never be restricted to one sector since many others, like aviation and MSMEs, are hit equally hard too.

Evidence shows such remedies are fraught with damaging consequences for the economy by worsening the debt crisis and weakening banking finances. But before getting there here is how big the debt crisis is.

What do GNPA ratios of 12.5% to 14.7% mean to Indian economy?

The RBI has stopped providing data on the non-performing assets (NPAs) it is writing off every year, thereby blunting accountability and transparency in its operations. It hasn't revealed the GNPA for FY20 in absolute number (in Rs crore) either, but says the GNPA ratio (GNPA/Gross Advances) in FY20 is 8.5%.

But this can be easily calculated. Here is how.

The simple averages of the GNPAs and Gross Advances of the SCBs for the previous five years between FY15 and FY19 (for which data is available in the RBI database) work out to be Rs 7.4 lakh crore and Rs 87.5 crore, respectively.

Let us assume these average holds for FY20.

Now the GNPA ratio for FY20 works out to be 8.5%, perfectly matching with the RBI's declaration (that is perhaps how the RBI calculated it too).

Assume also that the FY20 levels of GNPA and Gross Advance hold true for FY21. What would the projected rise in the GNPA ratios to 12.5% and 14.7% mean for the GNPA in absolute terms?

The GNPAs for FY21 would be Rs 11 lakh crore and Rs 13 lakh crore, respectively.

These are very big numbers - 7.5% to 9% of the FY20 GDP (GDP at constant prices for FY20 is Rs 145.66 lakh crore, according to the NSO's May 29, 2020 statement).

Imagine there is no GNPA for FY21. Banks would not have to set aside money as contingency cover. Also imagine if a part of the GNPA is not written off, partially or fully, in subsequent years.

The entire amount of Rs 11-13 lakh crore plus banks' provisioning against it would be available and work to revive the lockdown-hit economy.

Two important facts should be kept in mind here: (i) the RBI routinely writes of NPAs even when it is wilful (those who can pay but don't are classified as "wilful defaulters"), letting private corporates routinely get away with public money and (ii) the public sector banks (PSBs) account for more than 80% of total GNPAs in the SCBs (86% in FY18), which are compensated (recapitalised) later with more public money.

Writing off NPAs is a double loss to the economy: (i) loss of public money (deposits) in the SCBs (Rs 11-13 lakh crore) and (ii) the subsequent recapitalisation of PSBs with more public money (to the extent the NPAs are written off).

Dire warning against growing debt across world

Even before the pandemic hit, the world was witnessing a phenomenal rise in debt against which multiple agencies were issuing warnings. The lockdown would surely be worsening it.

For example, Kristalina Georgieva, managing director of the International Monetary Fund (IMF), warned on November 7, 2019, that the global debt - both public and private taken together - had reached an all-time high of $188 trillion or 230% of global output (GDP).

The IMF had organised a conference in Washington to discuss the development which she was addressing.

She cautioned: "Think of the devastating effects of unsustainable credit booms, including in the run-up to the global financial crisis (2007-08).A major driver of this build-up is the private sector, which currently makes up almost two-thirds of the total debt level."

She went on to explain: "But that is only part of the story...Remember: the build-up of public debt has a lot to do with the policy response to the 2008 financial crisis - when private debt moved to public balance sheets, especially in advanced economies. Recent IMF staff research shows that direct public support to financial institutions (banks and others) alone amounted to $1.6 trillion during the 2008 crisis."

Writing off NPAs (private businesses' loan defaults) by the RBI similarly shifts private debts to public accounts. India witnessed rapid lending in recent years - target-driven MUDRA loans and continuous lowering of interest rates that endured in the post-lockdown period. More than 90% of India's economic package of Rs 21 lakh crore consists of facilitating credit or liquidity infusion.

Here is the latest update on global and Indian debts.

The Washington-based Institute of International Finance (IIF), an association of financial industries, provides debt positions four times a year. Last updated in July 2020, its data is presented in the following graph, using only the debt position as on March 1 of every financial year.

The data shows, the total global debt stood at $258 trillion on March 1, 2020, which was 331% of the global output (GDP) - up from $184.4 or trillion 10 years earlier on March 1, 2010. Private sector debt accounted for 73% of the total GDP or $188 trillion (it includes household debt of $48.1 trillion).

What about India?

The IIF provides data for India only in terms of GDP, not in absolute value. Its data shows the total debt stood at 130% of the GDP in the January-March 2020 quarter. India's government debt stood at 69% of the GDP and that its private sector 61%. But that is only one part of the story

Indian businesses show highest debt-stress level

The US management consultancy firm McKinsey & Company had warned about debt-stress in corporate entities in its July 2019 report, "Signs of stress in the Asian financial system".

It singled out countries like India, where it said the signal was "ominous" and called for monetary policy reviews and preventive actions.

The report showed India's corporate sector had the highest level of debt-stress in the world in 2017 with 43% of long-term loans facing potential default (interest coverage ratio of less than 1.5) - a rise of 30% from 2007. This is far more than 37% for China but India never attracted the kind of global attention China did.

It further pointed out that the corporate debt-stress was spread across sectors: industrial (capital goods, commercial professional services, transportation etc.), utilities, energy, real estate, and materials (in decreasing order).

Though this graph doesn't differentiate between public and private sector corporates, data from the bankruptcy proceedings (under the Insolvency and Bankruptcy Code) and other financial reports show that debt stress is predominant in the private sector.

The McKinsey report also highlighted a structural weakness in India's lending system that remains unaddressed as yet: high-risk lending by poorly regulated non-banking financial institutions (NBFCs).

It said: "In India, while (regulated) banks reduced lending as defaults showed signs of growing around 2014, nonbank financial intermediaries continued to lend. The Reserve Bank of India, India's central bank, estimates that 99.7 percent of nonbank finance companies (NBFCs) and housing companies make long-term loans against short-term funding."

That India's corporate debt-stress remains elevated has been flagged off by the global financial services agency Credit Suisse for at least three consecutive years since FY17.

It's "India Corporate Health Tracker" of August 2019 shows that barring a few, all familiar big private business houses figure in the list of 49 "chronically stressed" corporates (interest cover ratio of less than 1 for a period of 1 to 12 quarters).

The names include one or more entities belonging to the Reliance, Tata and Adani stables. A few are public sector entities, like the SAIL, MTNL, Shipping Corporation, Mangalore Refinery, Petrochemicals, and Chennai Petroleum. Debt stress is spread across sectors like infrastructure, manufacturing, telecom, power, metals, textiles, etc.

The debt of these 49 chronically stressed companies has been consistently rising from Rs 8.9 lakh crore in FY17 to Rs 9.1 lakh crore in FY 18 and Rs 10.2 lakh crore in FY19.

Why Indian corporates are debt-ridden?

The findings of the McKinsey and Credit Suisse reports raise many fundamental questions.

Why are India's big and apparently successful corporate entities debt-ridden? Why don't they use their own money - accumulated profits and wealth over the years -or infuse equity for establishing new businesses or expanding existing ones? Are they really stressed or is it a deliberate ploy to misappropriate public money?

The last question arises not only because the Indian government and RBI routinely write off corporate loans as NPAs (even if wilful) without question (the data is also kept hidden from public eye) but also because a series of corporate frauds have flooded out in the past couple of years: PMC, PNB, IL&FS, HDIL, DHFL, Yes Bank, ICICI-Videocon, and NSEL scams to name some.

Some of these scams reveal years of fraudulent financial dealings, others demonstrate outright loot of public money (for example, Nirav Modi, Mehul Choksi, Vijay Mallya, Jatin Mehta and many others fled India after pocketing public money).

In all, 36 such businessmen fled in recent years, the Enforcement Directorate (ED) told a court. With the Insolvency and Bankruptcy Code now diluted, the misappropriation of public money is more likely.

Leaving aside malfeasance, debt-driven businesses are a common phenomenon. With the economic slowdown, the chances of defaults are now heightened with an already debt-stressed corporate sector.

Moratorium and restructuring of loans are bad ideas

Should the RBI then continue lowering interest rates to push supply-driven-credit? The repo rate (rate at which the RBI lends to banks) has fallen from 6% in April 2018 to 3.5% in May 2020, the capital reserve ratio (CRR) is down to 3% for FY21 with no corresponding gain seen in the economy.

Most of the liquidity gets parked in the RBI's reverse repo account and it is well known to bankers and policymakers. In effect, the RBI and government know liquidity infusion is a spectacular failure and yet the push for more of the same continues.

A day after the IMF's Kristalina Georgieva warned against the growing global debt, the main speaker of the event Jeremy Stein, a Harvard professor, issued a dire warning.

His presentation read: "Supply-driven credit booms - accompanied by aggressive pricing and erosion of credit quality - appear to play a big role in fluctuations in economic activity across a wide range of sample periods, countries, and institutional arrangements."

It said such supply-side credit push brings "not just financial crises, but garden-variety recessions as well."

Not long ago, economist Joseph Stiglitz too had warned against supply-drive debt push: "...periods of rapid lending are often associated with bubbles like the tech bubble and the real estate bubbles in the US. (There is again typically a causal link: rapid lending helps create and sustain these bubbles.) Such bubbles make the assessment of risk more difficult."

Here is a warning from India's largest public sector bank SBI about extending moratorium on debt repayment.

On August 3, 2020, its research paper said: (i) 70% of the total moratorium have been availed by corporates which are rated A and above - those who can easily repay with "comfortable debt-equity ratio" (those with comfortable debt-equity are spread across sectors like pharma, FMCG, chemicals, healthcare, consumer durable, auto, etc.) and (ii) consumer loans declined by Rs 53,023 crore in the current fiscal, but "consumer leverage in lieu of exposure to stock market" increased by Rs 469 crore that could be a potential source of financial instability".

It warned that a blanket extension of moratorium beyond August 31 would "do more harm than good".

As for restructuring of bad loans that the government talks of, the IBC was brought in in 2018 precisely because the earlier regime of restructuring was a disaster and ended up ever-greening bad loans and caused higher losses as more good public money was thrown after bad money year after year.

Here is more food for thought.

How does India's economic growth square up with growth in bank loans?

The following graph presents data from the RBI and NSO for a period of 15 years (FY06 to FY20).

The correlation seems tenuous, doesn't it? Thereby hangs another tale.

@Milspec @Deathstar @HariPrasad @Ashwin @Falcon your view

Rebooting Economy XIII: Why Indian corporates are debt-ridden

India faces a fresh threat of NPAs with RBI warning dramatic rise in loan default rate from 8.5% in FY20 to 14.7% in FY21. A global study shows the Indian corporate sector was most debt-stressed with 43% of long-term loans vulnerable to default even before the COVID-19 pandemic hit

On July 31, 2020, Finance Minister Nirmala Sitharaman announced that talks were on with the banking regulator RBI to extend the moratorium on repayments and restructuring of borrowings beyond August 31.

This was after the RBI released its Financial Stability Report on July 24 issuing a dire warning: Macro stress tests indicate that the Gross NPA (GNPA) ratio of the Scheduled Commercial Banks (SCBs) could rise from 8.5% in FY20 to 12.5% under baseline scenario and 14.7% under very severe stress in FY21 because of the lockdown-induced economic disruptions.

Although Sitharaman's statement came in the context of hospitality industry, extension of moratorium or restructuring of borrowings can never be restricted to one sector since many others, like aviation and MSMEs, are hit equally hard too.

Evidence shows such remedies are fraught with damaging consequences for the economy by worsening the debt crisis and weakening banking finances. But before getting there here is how big the debt crisis is.

What do GNPA ratios of 12.5% to 14.7% mean to Indian economy?

The RBI has stopped providing data on the non-performing assets (NPAs) it is writing off every year, thereby blunting accountability and transparency in its operations. It hasn't revealed the GNPA for FY20 in absolute number (in Rs crore) either, but says the GNPA ratio (GNPA/Gross Advances) in FY20 is 8.5%.

But this can be easily calculated. Here is how.

The simple averages of the GNPAs and Gross Advances of the SCBs for the previous five years between FY15 and FY19 (for which data is available in the RBI database) work out to be Rs 7.4 lakh crore and Rs 87.5 crore, respectively.

Let us assume these average holds for FY20.

Now the GNPA ratio for FY20 works out to be 8.5%, perfectly matching with the RBI's declaration (that is perhaps how the RBI calculated it too).

Assume also that the FY20 levels of GNPA and Gross Advance hold true for FY21. What would the projected rise in the GNPA ratios to 12.5% and 14.7% mean for the GNPA in absolute terms?

The GNPAs for FY21 would be Rs 11 lakh crore and Rs 13 lakh crore, respectively.

These are very big numbers - 7.5% to 9% of the FY20 GDP (GDP at constant prices for FY20 is Rs 145.66 lakh crore, according to the NSO's May 29, 2020 statement).

Imagine there is no GNPA for FY21. Banks would not have to set aside money as contingency cover. Also imagine if a part of the GNPA is not written off, partially or fully, in subsequent years.

The entire amount of Rs 11-13 lakh crore plus banks' provisioning against it would be available and work to revive the lockdown-hit economy.

Two important facts should be kept in mind here: (i) the RBI routinely writes of NPAs even when it is wilful (those who can pay but don't are classified as "wilful defaulters"), letting private corporates routinely get away with public money and (ii) the public sector banks (PSBs) account for more than 80% of total GNPAs in the SCBs (86% in FY18), which are compensated (recapitalised) later with more public money.

Writing off NPAs is a double loss to the economy: (i) loss of public money (deposits) in the SCBs (Rs 11-13 lakh crore) and (ii) the subsequent recapitalisation of PSBs with more public money (to the extent the NPAs are written off).

Dire warning against growing debt across world

Even before the pandemic hit, the world was witnessing a phenomenal rise in debt against which multiple agencies were issuing warnings. The lockdown would surely be worsening it.

For example, Kristalina Georgieva, managing director of the International Monetary Fund (IMF), warned on November 7, 2019, that the global debt - both public and private taken together - had reached an all-time high of $188 trillion or 230% of global output (GDP).

The IMF had organised a conference in Washington to discuss the development which she was addressing.

She cautioned: "Think of the devastating effects of unsustainable credit booms, including in the run-up to the global financial crisis (2007-08).A major driver of this build-up is the private sector, which currently makes up almost two-thirds of the total debt level."

She went on to explain: "But that is only part of the story...Remember: the build-up of public debt has a lot to do with the policy response to the 2008 financial crisis - when private debt moved to public balance sheets, especially in advanced economies. Recent IMF staff research shows that direct public support to financial institutions (banks and others) alone amounted to $1.6 trillion during the 2008 crisis."

Writing off NPAs (private businesses' loan defaults) by the RBI similarly shifts private debts to public accounts. India witnessed rapid lending in recent years - target-driven MUDRA loans and continuous lowering of interest rates that endured in the post-lockdown period. More than 90% of India's economic package of Rs 21 lakh crore consists of facilitating credit or liquidity infusion.

Here is the latest update on global and Indian debts.

The Washington-based Institute of International Finance (IIF), an association of financial industries, provides debt positions four times a year. Last updated in July 2020, its data is presented in the following graph, using only the debt position as on March 1 of every financial year.

View attachment 17050

The data shows, the total global debt stood at $258 trillion on March 1, 2020, which was 331% of the global output (GDP) - up from $184.4 or trillion 10 years earlier on March 1, 2010. Private sector debt accounted for 73% of the total GDP or $188 trillion (it includes household debt of $48.1 trillion).

What about India?

The IIF provides data for India only in terms of GDP, not in absolute value. Its data shows the total debt stood at 130% of the GDP in the January-March 2020 quarter. India's government debt stood at 69% of the GDP and that its private sector 61%. But that is only one part of the story

View attachment 17051

Indian businesses show highest debt-stress level

The US management consultancy firm McKinsey & Company had warned about debt-stress in corporate entities in its July 2019 report, "Signs of stress in the Asian financial system".

It singled out countries like India, where it said the signal was "ominous" and called for monetary policy reviews and preventive actions.

The report showed India's corporate sector had the highest level of debt-stress in the world in 2017 with 43% of long-term loans facing potential default (interest coverage ratio of less than 1.5) - a rise of 30% from 2007. This is far more than 37% for China but India never attracted the kind of global attention China did.

It further pointed out that the corporate debt-stress was spread across sectors: industrial (capital goods, commercial professional services, transportation etc.), utilities, energy, real estate, and materials (in decreasing order).

Though this graph doesn't differentiate between public and private sector corporates, data from the bankruptcy proceedings (under the Insolvency and Bankruptcy Code) and other financial reports show that debt stress is predominant in the private sector.

The McKinsey report also highlighted a structural weakness in India's lending system that remains unaddressed as yet: high-risk lending by poorly regulated non-banking financial institutions (NBFCs).

It said: "In India, while (regulated) banks reduced lending as defaults showed signs of growing around 2014, nonbank financial intermediaries continued to lend. The Reserve Bank of India, India's central bank, estimates that 99.7 percent of nonbank finance companies (NBFCs) and housing companies make long-term loans against short-term funding."

That India's corporate debt-stress remains elevated has been flagged off by the global financial services agency Credit Suisse for at least three consecutive years since FY17.

It's "India Corporate Health Tracker" of August 2019 shows that barring a few, all familiar big private business houses figure in the list of 49 "chronically stressed" corporates (interest cover ratio of less than 1 for a period of 1 to 12 quarters).

The names include one or more entities belonging to the Reliance, Tata and Adani stables. A few are public sector entities, like the SAIL, MTNL, Shipping Corporation, Mangalore Refinery, Petrochemicals, and Chennai Petroleum. Debt stress is spread across sectors like infrastructure, manufacturing, telecom, power, metals, textiles, etc.

The debt of these 49 chronically stressed companies has been consistently rising from Rs 8.9 lakh crore in FY17 to Rs 9.1 lakh crore in FY 18 and Rs 10.2 lakh crore in FY19.

Why Indian corporates are debt-ridden?

The findings of the McKinsey and Credit Suisse reports raise many fundamental questions.

Why are India's big and apparently successful corporate entities debt-ridden? Why don't they use their own money - accumulated profits and wealth over the years -or infuse equity for establishing new businesses or expanding existing ones? Are they really stressed or is it a deliberate ploy to misappropriate public money?

The last question arises not only because the Indian government and RBI routinely write off corporate loans as NPAs (even if wilful) without question (the data is also kept hidden from public eye) but also because a series of corporate frauds have flooded out in the past couple of years: PMC, PNB, IL&FS, HDIL, DHFL, Yes Bank, ICICI-Videocon, and NSEL scams to name some.

Some of these scams reveal years of fraudulent financial dealings, others demonstrate outright loot of public money (for example, Nirav Modi, Mehul Choksi, Vijay Mallya, Jatin Mehta and many others fled India after pocketing public money).

In all, 36 such businessmen fled in recent years, the Enforcement Directorate (ED) told a court. With the Insolvency and Bankruptcy Code now diluted, the misappropriation of public money is more likely.

Leaving aside malfeasance, debt-driven businesses are a common phenomenon. With the economic slowdown, the chances of defaults are now heightened with an already debt-stressed corporate sector.

Moratorium and restructuring of loans are bad ideas

Should the RBI then continue lowering interest rates to push supply-driven-credit? The repo rate (rate at which the RBI lends to banks) has fallen from 6% in April 2018 to 3.5% in May 2020, the capital reserve ratio (CRR) is down to 3% for FY21 with no corresponding gain seen in the economy.

Most of the liquidity gets parked in the RBI's reverse repo account and it is well known to bankers and policymakers. In effect, the RBI and government know liquidity infusion is a spectacular failure and yet the push for more of the same continues.

A day after the IMF's Kristalina Georgieva warned against the growing global debt, the main speaker of the event Jeremy Stein, a Harvard professor, issued a dire warning.

His presentation read: "Supply-driven credit booms - accompanied by aggressive pricing and erosion of credit quality - appear to play a big role in fluctuations in economic activity across a wide range of sample periods, countries, and institutional arrangements."

It said such supply-side credit push brings "not just financial crises, but garden-variety recessions as well."

Not long ago, economist Joseph Stiglitz too had warned against supply-drive debt push: "...periods of rapid lending are often associated with bubbles like the tech bubble and the real estate bubbles in the US. (There is again typically a causal link: rapid lending helps create and sustain these bubbles.) Such bubbles make the assessment of risk more difficult."

Here is a warning from India's largest public sector bank SBI about extending moratorium on debt repayment.

On August 3, 2020, its research paper said: (i) 70% of the total moratorium have been availed by corporates which are rated A and above - those who can easily repay with "comfortable debt-equity ratio" (those with comfortable debt-equity are spread across sectors like pharma, FMCG, chemicals, healthcare, consumer durable, auto, etc.) and (ii) consumer loans declined by Rs 53,023 crore in the current fiscal, but "consumer leverage in lieu of exposure to stock market" increased by Rs 469 crore that could be a potential source of financial instability".

It warned that a blanket extension of moratorium beyond August 31 would "do more harm than good".

As for restructuring of bad loans that the government talks of, the IBC was brought in in 2018 precisely because the earlier regime of restructuring was a disaster and ended up ever-greening bad loans and caused higher losses as more good public money was thrown after bad money year after year.

Here is more food for thought.

How does India's economic growth square up with growth in bank loans?

The following graph presents data from the RBI and NSO for a period of 15 years (FY06 to FY20).

View attachment 17052

The correlation seems tenuous, doesn't it? Thereby hangs another tale.

@Milspec @Deathstar @HariPrasad @Ashwin @Falcon your view

My advice to you bro is to not pay much attention to these manipulated jargon and graphs. I have lost interest in that much earlier. Just pay attention to how the lower most people of income pyramid are taken care of and how much is spent on uplifting the people and their problem solving. In my opinion, a great work is done in last 4 years and a solid foundation is laid down for a strong economy by putting money in the hand of people who were not able to afford anything except food. Enlargement of middle class with unsatisfied need is the key to demand pool growth. Supply push growth is fiction in current time when industry has the capacity to supply as much as demand arises. We saw this in covid 19 case where lots of units popped up to meet all the demand explosion because of pandemic.

Sorry for being off the topic but I have seen these useless graphs making little difference in an ordinary human being's life. I am in no mood to read that long article and respond to it. Pardon me for that.

Explained: Why are forex reserves shooting up when Indian economy is hit?

Covid-hit India’s foreign exchange reserves jumped by a record $11.9 billion in the week ending July 31 to hit a fresh high of $534.5 billion, making it the fifth largest holder of reserves in the world. During the 10-month period between September 27, 2019 and July 31, 2020, the foreign exchange reserves have swelled by $100 billion.

At a time when the economy is under stress and the growth is expected to contract in 2020-21, the rising forex reserves have come as a breather as it can cover India’s import bill of more than one year.

India’s foreign exchange reserves: How has the rise been?

The trend of rising foreign exchange reserves started after Finance Minister Nirmala Sitharaman announced a sharp cut in corporate tax rates on September 20, 2019. While investor sentiments turned weak after the budget announcement in July to impose higher surcharge, the government’s decision to reverse its budget decision relating to higher surcharge impact on FPIs along with a cut in the corporate tax rate in September played a significant role in turning the investors mood and draw them to invest in the Indian economy and markets.

Between September 20, 2019 and July 31, 2020, the reserves have grown by $106 billion and, since the beginning of April, it has grown by $60 billion. So, in ten months India has added 25 per cent of the reserves it had till September 20, 2019. India is now fifth in global ranking behind China ($ 3,298 billion), Japan ($ 1,383 billion), Switzerland ($ 896 billion) and Russia ($ 591 billion).

What has led to this rise in forex reserves?

The rise has been in several stages and has been led by different factors over the last ten months. Experts say that the rise in foreign exchange inflows through Foreign portfolio investment (FPI) and Foreign Direct Investment (FDI and has also been supported by decline in import bill over the last 4-5 months on account of dip in crude prices and trade impact following Covid-19 pandemic.

Forex reserves so far in FY21

Forex reserves so far in FY21

Some of the key factors include:

FPI inflows: While it started with a sharp rise in FPI inflows following the government’s decision in September to cut corporate tax rate. Between April and December 2019, FPIs pumped in a net $15.1 billion, according to the RBI.

Dip in crude oil prices: India’s oil import bill declined as the global spread of coronavirus since February 2020 not only roiled the stock markets but also led to a crash in the Brent crude oil prices. While crude accounts for almost 20 per cent of India’s total import bill, Brent crude oil prices fell to levels of $20 per barrel towards March end, it dropped further and traded between $9 and $20 in April. In January 2020, Brent crude was trading between $60 and $70 per barrel.

Import savings: Lockdown across countries in response to Covid-19 pandemic impacted global trade and has resulted in a sharp dip in import expenditure — electronics, gold and also crude oil prices among others.

FDI inflows: Between September 2019 and March 2020 foreign direct investments stood at $23.88 billion and in April and May it amounted to $5.9 billion. Market experts say that a lot of FDI has also come in June and July too, especially the Rs 1 lakh crore plus investment by global tech giants in Jio Platforms. Thus FDI inflow has been a significant contributor to the rise in foreign exchange reserves.

Dip in gold imports: Gold which was a big import component for India witnessed a sharp decline in the quarter ended June 2020 following the high prices and the lockdown induced by the Covid-19 pandemic. According to the World Gold Council (WGC), gold imports plummeted by 95 per cent to 11.6 tonnes in the quarter as compared to 247.4 tonnes in the same period a year ago due to logistical issues and poor demand. The value of gold transacted during the June quarter fell to Rs 26,600 crore, down by 57 per cent as compared to Rs 62,420 crore a year ago, WGC said.

What does the rising forex reserves mean?

The rising forex reserves give a lot of comfort to the government and the Reserve Bank of India in managing India’s external and internal financial issues at a time when the economic growth is set to contract by 5.8 per cent in 2020-21. It’s a big cushion in the event of any crisis on the economic front and enough to cover the import bill of the country for a year. The rising reserves have also helped the rupee to strengthen against the dollar. The foreign exchange reserves to GDP ratio is around 15 per cent. Reserves will provide a level of confidence to markets that a country can meet its external obligations, demonstrate the backing of domestic currency by external assets, assist the government in meeting its foreign exchange needs and external debt obligations and maintain a reserve for national disasters or emergencies. “Adequate forex reserves should provide room for the RBI to cut rates and support recovery. We estimate that the RBI can sell $50 bn to defend the rupee in case of a speculative attack. Of note, RBI action to support growth should attract FPI equity flows,” says a Bank of America report.

What does the RBI do with the forex reserves?

The Reserve Bank functions as the custodian and manager of forex reserves, and operates within the overall policy framework agreed upon with the government. The RBI allocates the dollars for specific purposes. For example, under the Liberalised Remittances Scheme, individuals are allowed to remit up to $250,000 every year. The RBI uses its forex kitty for the orderly movement of the rupee. It sells the dollar when the rupee weakens and buys the dollar when the rupee strengthens. Of late, the RBI has been buying dollars from the market to shore up the forex reserves. When the RBI mops up dollars, it releases an equal amount in the rupees. This excess liquidity is sterilised through issue of bonds and securities and LAF operations to prevent a rise in inflation.

Are forex reserves giving returns to India?

Only gold reserves have given big returns to India. While the RBI has not disclosed the actual returns from forex reserves, experts estimate India is likely to get only negligible returns as interest rates in the US and Eurozone are around one per cent. On the contrary, India could be facing a cost to keep the reserves abroad. Out of the total foreign currency assets, as much as 59.7 per cent was invested in securities abroad, 33.37 per cent was deposited with other central banks of other countries and the BIS and the balance 7.06 per cent comprised deposits with commercial banks overseas as of March 2020. Further, as at end-March, 2020, the RBI held 653.01 tonnes of gold, with 360.71 tonnes being held overseas in safe custody with the Bank of England and the Bank for International Settlements, while the remaining gold is held domestically. With gold prices shooting up around 40 per cent to over Rs 55,000 per 10 grams this year, the value of gold holdings has shot up.

indianexpress.com

indianexpress.com

Covid-hit India’s foreign exchange reserves jumped by a record $11.9 billion in the week ending July 31 to hit a fresh high of $534.5 billion, making it the fifth largest holder of reserves in the world. During the 10-month period between September 27, 2019 and July 31, 2020, the foreign exchange reserves have swelled by $100 billion.

At a time when the economy is under stress and the growth is expected to contract in 2020-21, the rising forex reserves have come as a breather as it can cover India’s import bill of more than one year.

India’s foreign exchange reserves: How has the rise been?

The trend of rising foreign exchange reserves started after Finance Minister Nirmala Sitharaman announced a sharp cut in corporate tax rates on September 20, 2019. While investor sentiments turned weak after the budget announcement in July to impose higher surcharge, the government’s decision to reverse its budget decision relating to higher surcharge impact on FPIs along with a cut in the corporate tax rate in September played a significant role in turning the investors mood and draw them to invest in the Indian economy and markets.

Between September 20, 2019 and July 31, 2020, the reserves have grown by $106 billion and, since the beginning of April, it has grown by $60 billion. So, in ten months India has added 25 per cent of the reserves it had till September 20, 2019. India is now fifth in global ranking behind China ($ 3,298 billion), Japan ($ 1,383 billion), Switzerland ($ 896 billion) and Russia ($ 591 billion).

What has led to this rise in forex reserves?

The rise has been in several stages and has been led by different factors over the last ten months. Experts say that the rise in foreign exchange inflows through Foreign portfolio investment (FPI) and Foreign Direct Investment (FDI and has also been supported by decline in import bill over the last 4-5 months on account of dip in crude prices and trade impact following Covid-19 pandemic.

Some of the key factors include:

FPI inflows: While it started with a sharp rise in FPI inflows following the government’s decision in September to cut corporate tax rate. Between April and December 2019, FPIs pumped in a net $15.1 billion, according to the RBI.

Dip in crude oil prices: India’s oil import bill declined as the global spread of coronavirus since February 2020 not only roiled the stock markets but also led to a crash in the Brent crude oil prices. While crude accounts for almost 20 per cent of India’s total import bill, Brent crude oil prices fell to levels of $20 per barrel towards March end, it dropped further and traded between $9 and $20 in April. In January 2020, Brent crude was trading between $60 and $70 per barrel.

Import savings: Lockdown across countries in response to Covid-19 pandemic impacted global trade and has resulted in a sharp dip in import expenditure — electronics, gold and also crude oil prices among others.

FDI inflows: Between September 2019 and March 2020 foreign direct investments stood at $23.88 billion and in April and May it amounted to $5.9 billion. Market experts say that a lot of FDI has also come in June and July too, especially the Rs 1 lakh crore plus investment by global tech giants in Jio Platforms. Thus FDI inflow has been a significant contributor to the rise in foreign exchange reserves.

Dip in gold imports: Gold which was a big import component for India witnessed a sharp decline in the quarter ended June 2020 following the high prices and the lockdown induced by the Covid-19 pandemic. According to the World Gold Council (WGC), gold imports plummeted by 95 per cent to 11.6 tonnes in the quarter as compared to 247.4 tonnes in the same period a year ago due to logistical issues and poor demand. The value of gold transacted during the June quarter fell to Rs 26,600 crore, down by 57 per cent as compared to Rs 62,420 crore a year ago, WGC said.

What does the rising forex reserves mean?

The rising forex reserves give a lot of comfort to the government and the Reserve Bank of India in managing India’s external and internal financial issues at a time when the economic growth is set to contract by 5.8 per cent in 2020-21. It’s a big cushion in the event of any crisis on the economic front and enough to cover the import bill of the country for a year. The rising reserves have also helped the rupee to strengthen against the dollar. The foreign exchange reserves to GDP ratio is around 15 per cent. Reserves will provide a level of confidence to markets that a country can meet its external obligations, demonstrate the backing of domestic currency by external assets, assist the government in meeting its foreign exchange needs and external debt obligations and maintain a reserve for national disasters or emergencies. “Adequate forex reserves should provide room for the RBI to cut rates and support recovery. We estimate that the RBI can sell $50 bn to defend the rupee in case of a speculative attack. Of note, RBI action to support growth should attract FPI equity flows,” says a Bank of America report.

What does the RBI do with the forex reserves?

The Reserve Bank functions as the custodian and manager of forex reserves, and operates within the overall policy framework agreed upon with the government. The RBI allocates the dollars for specific purposes. For example, under the Liberalised Remittances Scheme, individuals are allowed to remit up to $250,000 every year. The RBI uses its forex kitty for the orderly movement of the rupee. It sells the dollar when the rupee weakens and buys the dollar when the rupee strengthens. Of late, the RBI has been buying dollars from the market to shore up the forex reserves. When the RBI mops up dollars, it releases an equal amount in the rupees. This excess liquidity is sterilised through issue of bonds and securities and LAF operations to prevent a rise in inflation.

Are forex reserves giving returns to India?

Only gold reserves have given big returns to India. While the RBI has not disclosed the actual returns from forex reserves, experts estimate India is likely to get only negligible returns as interest rates in the US and Eurozone are around one per cent. On the contrary, India could be facing a cost to keep the reserves abroad. Out of the total foreign currency assets, as much as 59.7 per cent was invested in securities abroad, 33.37 per cent was deposited with other central banks of other countries and the BIS and the balance 7.06 per cent comprised deposits with commercial banks overseas as of March 2020. Further, as at end-March, 2020, the RBI held 653.01 tonnes of gold, with 360.71 tonnes being held overseas in safe custody with the Bank of England and the Bank for International Settlements, while the remaining gold is held domestically. With gold prices shooting up around 40 per cent to over Rs 55,000 per 10 grams this year, the value of gold holdings has shot up.

Explained: Why are forex reserves shooting up when Indian economy is hit?

At a time when the economy is under stress and the growth is expected to contract in 2020-21, the rising forex reserves have come as a breather for the economy as it can cover India’s import bill of more than one year.